Social Security Scams: Protect Yourself from Social Security Scams | SSA

Social Security, a vital safety net for retirees, disabled individuals, and survivors, is a program that millions of Americans rely on. However, it’s not just beneficiaries who are interested in your Social Security number; scammers are, too. In this blog post, we’ll dive into the world of “Social Security Scams,” deceptive schemes that target individuals of all ages. We’ll explore the tactics scammers employ, the risks involved, and, most importantly, how to recognize and protect yourself from these fraudulent maneuvers.

Understanding Social Security Scams

Social Security Scams encompass a range of deceptive practices, with scammers posing as government officials or representatives to exploit individuals’ trust and fear of losing their benefits. These scams often aim to steal personal information or extort money. Here’s a closer look at how these scams typically unfold:

The Anatomy of Social Security Scams:

- Impersonation: Scammers impersonate Social Security Administration (SSA) employees, law enforcement officers, or government officials. They often use spoofed phone numbers to make their calls appear legitimate.

- Threats and Coercion: Scammers use fear tactics, such as threatening arrest, suspension of benefits, or legal action, to manipulate victims into complying with their demands.

- Request for Personal Information: Victims are asked to provide personal information, including their Social Security number, bank account details, or other sensitive data, under the pretense of verifying their identity or resolving an issue.

- Payment Demands: Some scams involve demanding payments or gift cards to resolve alleged issues with Social Security benefits. Victims are coerced into making payments to avoid dire consequences.

- Identity Theft: With the information obtained, scammers can engage in identity theft, potentially leading to unauthorized transactions, credit card fraud, or other financial losses.

Recognizing the Red Flags

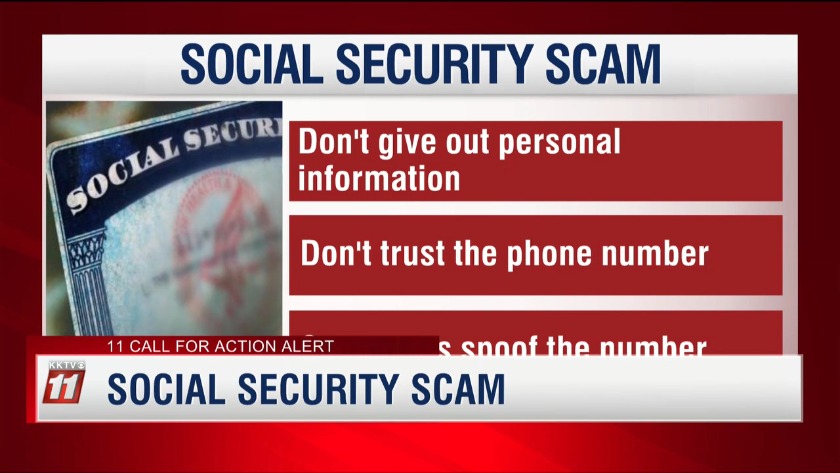

Spotting the warning signs of Social Security Scams is crucial for safeguarding your personal information and finances. Here are common indicators to be aware of:

- Unexpected Calls: Be wary of unsolicited phone calls or messages claiming to be from the SSA or government agencies. Government agencies typically communicate through official channels, not unsolicited calls.

- Pressure and Threats: Scammers often use high-pressure tactics and threats of arrest, fines, or benefit suspension to intimidate victims. Remember, government agencies do not make such threats over the phone.

- Request for Personal Information: Legitimate government agencies will not ask you to provide sensitive information like your Social Security number or bank details over the phone or via email.

- Demand for Payments: Scammers demanding payments or gift cards to resolve issues should raise immediate suspicion. Government agencies do not ask for payments in this manner.

- Caller ID Spoofing: Scammers may manipulate caller ID information to make it appear as if they are calling from a government agency or official number.

Protecting Yourself From Social Security Scams

Defending against Social Security Scams requires vigilance and informed decision-making:

- Verify Caller Identity: If you receive an unsolicited call claiming to be from the SSA or a government agency, hang up and independently verify the caller’s identity. Contact the agency through official channels.

- Do Not Share Personal Information: Never provide sensitive information like your Social Security number or bank details over the phone or via email unless you initiated the contact through official channels.

- Question Threats: Government agencies do not threaten individuals with arrest or benefits suspension over the phone. If you encounter such threats, treat them with skepticism.

- Hang Up on Suspicious Calls: If you suspect a call is a scam, hang up immediately. Do not engage with the caller.

- Report Suspected Scams: If you encounter a potential Social Security Scam, report it to relevant authorities, such as the SSA’s Office of the Inspector General or the Federal Trade Commission (FTC).

Conclusion

Social Security Scams prey on the trust and fear of individuals, aiming to steal personal information and extort money. It’s essential to stay informed, exercise caution, and recognize the red flags associated with these scams. Remember, government agencies communicate through official channels and do not make threats or demand payments over the phone. By staying vigilant and protecting your personal information, you can ensure that your Social Security remains safe and secure from the grasp of deceptive fraudsters.