Zelle Scam Alert: Facebook Marketplace Zelle Scams

In today’s digital age, online payment services have made transferring money more convenient than ever. One such service is Zelle, a platform that allows users to send and receive money with ease. However, as with any online financial tool, scammers have found ways to exploit it through what is known as the “Zelle Scam.” In this blog post, we will delve into the Zelle Scam: what it entails, how it works, and most importantly, how to recognize and protect yourself from this deceptive scheme.

Understanding the Zelle Scam

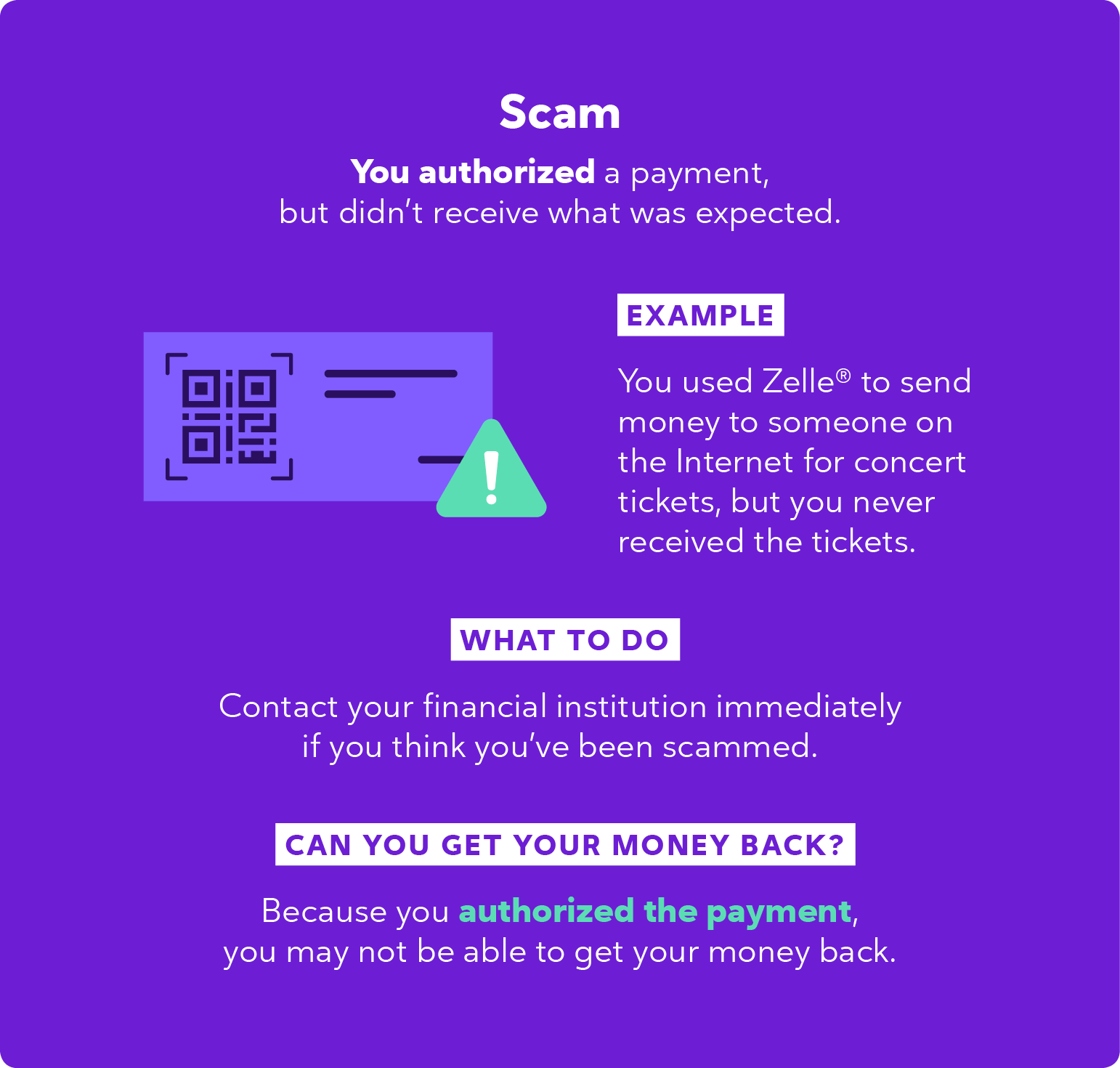

The Zelle Scam is a fraudulent scheme where scammers use Zelle as a vehicle to steal money or personal information from unsuspecting victims. These scammers often pose as buyers or sellers in online marketplaces, convincing individuals to use Zelle for transactions. Once money is transferred through Zelle, it can be difficult to recover, making this scam particularly lucrative for fraudsters.

The Anatomy of the Zelle Scam

The Zelle Scam often follows a common pattern, typically unfolding as follows:

- Impersonation: Scammers create fake profiles or listings on online marketplaces, pretending to be buyers or sellers interested in an item.

- Transaction Request: They persuade the victim to use Zelle for the transaction, often citing convenience or the promise of a better deal.

- Payment Sent: The victim sends the agreed-upon amount via Zelle, believing they are making a legitimate purchase.

- No Product or Service: After receiving the payment, the scammer disappears, leaving the victim with no product or service and no way to reclaim the money.

Recognizing the Red Flags

Identifying the warning signs of the Zelle Scam is crucial for protecting your money and personal information. Here are common indicators to be aware of:

- Unsolicited Offers: Be cautious of unsolicited buyers or sellers on online marketplaces, especially those who insist on using Zelle for transactions.

- No Verification: Scammers often avoid in-person or video verification, preferring to conduct transactions solely through text or email.

- Too Good to Be True: If a deal seems too good to be true or raises suspicions, it’s essential to exercise caution.

- No Recourse: Understand that Zelle transactions are typically irreversible, so once the money is sent, it may be challenging to recover.

Protecting Yourself From the Zelle Scam

Defending against the Zelle Scam requires vigilance and informed decision-making:

- Verify Identities: Always verify the identities of buyers or sellers in online marketplaces, and prefer in-person or video verification when possible.

- Use Trusted Payment Methods: Use payment methods that offer buyer and seller protection, such as PayPal or credit cards, for online transactions.

- Beware of Pressure: Be cautious of buyers or sellers who pressure you to use Zelle for transactions or demand immediate payment.

- Check Transaction Details: Double-check the transaction details, including the recipient’s email or phone number, before sending money via Zelle.

- Report Suspected Scams: If you suspect you have encountered the Zelle Scam or any other fraudulent activity, report it to your local law enforcement, the Federal Trade Commission (FTC), and your bank.

Conclusion

The Zelle Scam capitalizes on our reliance on online payment services, but with awareness and caution, you can protect your money and personal information. Remember that legitimate buyers and sellers should be willing to verify their identities and conduct transactions through secure and protected payment methods. By adhering to these guidelines, you can navigate the world of online transactions with confidence and avoid becoming a victim of deceptive scams.