Zelle Business Account Scams: Zelle Scams To Watch Out For

Zelle, a widely used digital payments platform, offers a convenient way for businesses to send and receive money quickly. However, this ease of use has also made Zelle a target for scammers looking to exploit business accounts. In this blog post, we will explore the world of Zelle Business Account scams: what they involve, how they work, and, most importantly, how to recognize and protect your business from these deceptive schemes.

Understanding Zelle Business Account Scams

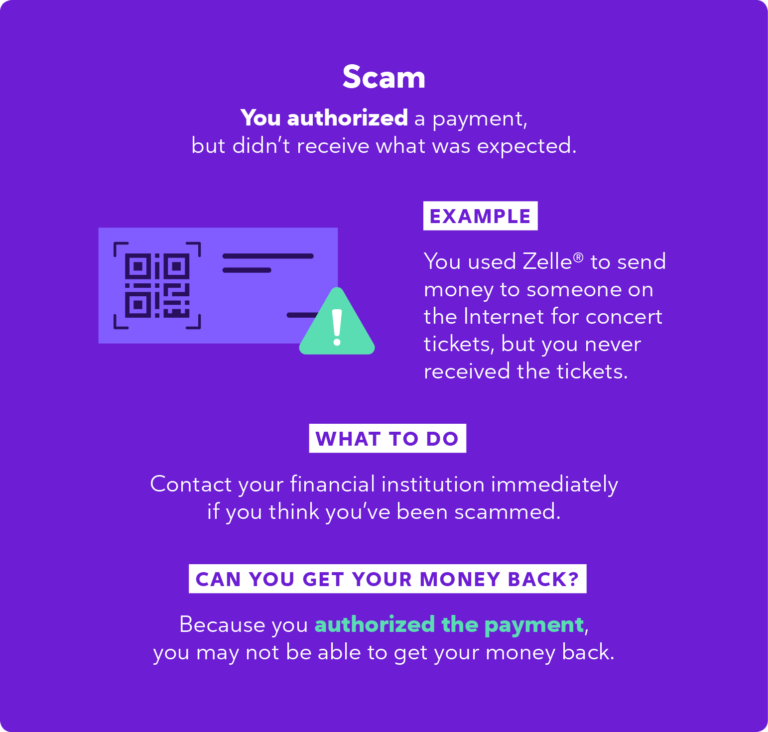

Zelle Business Account scams involve fraudulent activities that specifically target business users of the platform. These scams often aim to trick businesses into sending money to scammers under false pretenses, resulting in financial losses for the victimized company.

The Anatomy of Zelle Business Account Scams

Zelle Business Account scams often follow a common pattern, typically unfolding as follows:

- Impersonation: Scammers may impersonate a client, vendor, or other business partner, often using compromised or fake email addresses that closely resemble legitimate ones.

- Fake Invoices or Payment Requests: Scammers send invoices or payment requests to the business, claiming they need immediate payment for services, products, or outstanding bills.

- Urgency: The scammer may create a sense of urgency, insisting that payment must be made immediately to avoid penalties, late fees, or service disruptions.

- Use of Pressure Tactics: Scammers may pressure businesses to send money quickly, often within a short time frame, discouraging them from verifying the legitimacy of the request.

- Altered Payment Details: In some cases, scammers may provide altered bank account or payment information, diverting the funds to their own accounts.

- Disappearing Act: After receiving the payment, the scammer disappears, and the business realizes they’ve fallen victim to a fraudulent scheme.

Recognizing the Red Flags

Spotting the warning signs of Zelle Business Account scams is crucial for protecting your business from financial losses. Here are common indicators to be aware of:

- Urgent Payment Requests: Be cautious of unexpected payment requests that demand immediate action. Take the time to verify the legitimacy of the request.

- Unusual Payment Methods: Be wary if the request asks you to use payment methods or bank accounts that differ from your usual transaction process with the vendor or client.

- Altered Payment Details: Double-check all payment details, including bank account numbers and recipient names, to ensure they match your records.

- Check Email Addresses: Scrutinize email addresses closely to detect any slight variations or misspellings in the sender’s email, which may indicate an impersonation attempt.

- Independently Verify: Contact the requester through known and verified communication channels, such as a phone number from your records, to confirm the payment request’s authenticity.

Protecting Your Business From Zelle Business Account Scams

Defending against Zelle Business Account scams requires vigilance and informed decision-making:

- Establish Verification Protocols: Implement clear verification processes for payment requests, especially for large or unusual transactions.

- Educate Employees: Train your staff to recognize the red flags of scams and the importance of independently verifying payment requests.

- Secure Communication: Use secure communication channels, such as encrypted email or direct phone calls, for sensitive financial transactions.

- Check Sender Details: Carefully inspect sender email addresses for any discrepancies and encourage employees to do the same.

- Confirm Requests: Independently verify payment requests by contacting the requester through a trusted channel, using contact information from your records.

- Report Suspected Scams: If you encounter a Zelle Business Account scam or suspect fraudulent activity, report it to your bank and local law enforcement.

Conclusion

Zelle Business Account scams can be financially devastating for businesses. By staying informed, practicing caution, and recognizing the red flags associated with these scams, you can protect your business from falling victim to deceptive schemes. Remember that taking the time to verify payment requests is a crucial step in safeguarding your company’s financial assets and reputation.