Ponzi Scam: What Is A Ponzi Scam?

In the intricate world of finance and investments, one term that has gained notoriety over the years is the “Ponzi scam.” This fraudulent investment scheme, named after the infamous Charles Ponzi, operates on a simple premise – promise high returns with little to no risk. However, behind the façade of lucrative opportunities lies a web of deceit that eventually unravels, leaving investors in financial ruin.

What is a Ponzi Scam?

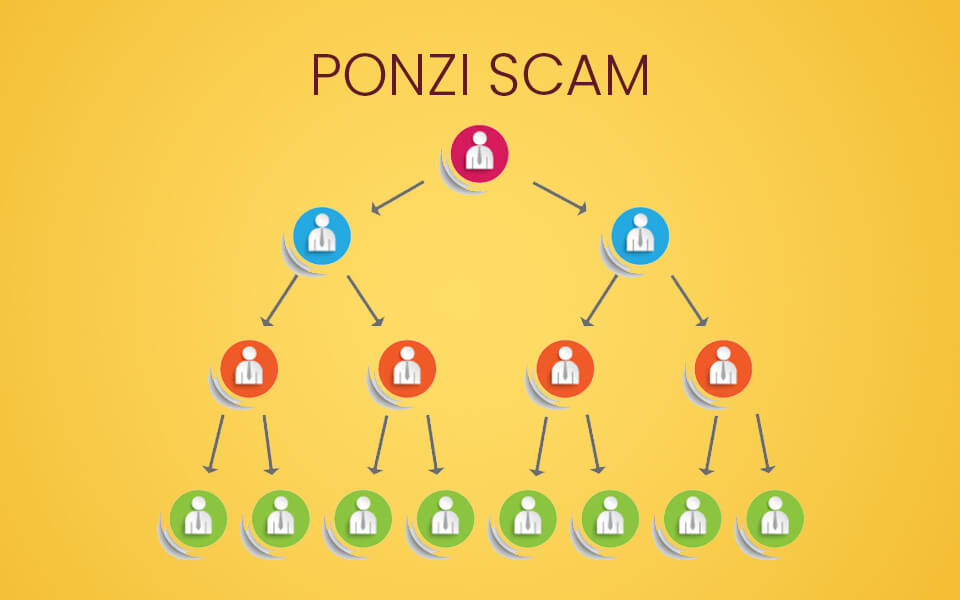

A Ponzi scam is an elaborate financial fraud that entices investors with promises of high returns on their investments. The scheme involves the payment of purported returns to existing investors from funds contributed by new investors, rather than from profit earned by the operation of a legitimate business.

Key Characteristics of a Ponzi Scam:

- High Returns, Low Risk:

- Ponzi schemes lure investors by offering returns that seem too good to be true. These returns often exceed what is attainable through traditional and legitimate investment channels. The promise of minimal risk convinces individuals to part with their hard-earned money.

- Illusion of Legitimate Business:

- Ponzi operators go to great lengths to create an illusion of a legitimate business. They may provide fabricated financial statements, fake documentation, and even host events to showcase the purported success of their ventures.

- Relying on New Investor Funds:

- Unlike legitimate investments that generate returns through profitable ventures, Ponzi scams depend on funds from new investors to pay off existing ones. This creates a cycle where the scammer continually needs an influx of new capital to sustain the illusion of profitability.

- Lack of Transparency:

- Ponzi operators deliberately maintain a lack of transparency regarding the investment strategy or the use of funds. Investors are often kept in the dark about how their money is being utilized, making it challenging for them to discern the fraudulent nature of the scheme.

How Ponzi Schemes Unravel:

The longevity of a Ponzi scheme is inherently limited, as it relies on a continuous influx of new investors. When the operator struggles to attract fresh capital or when a significant number of existing investors demand their returns, the scheme collapses. The unraveling process is marked by:

- Inability to Meet Obligations:

- As the operator struggles to meet the promised returns, delays or excuses may arise. The facade begins to crumble when more investors question the legitimacy of the operation.

- Panic and Mass Withdrawals:

- Fear and skepticism spread among investors, leading to a rush for withdrawals. The scheme’s operator may resort to paying returns to some investors using the capital from others, further accelerating the collapse.

- Legal Consequences:

- As the Ponzi scheme collapses, authorities step in to investigate. Legal actions are taken against the operators, who may face criminal charges for fraud and financial misconduct.

Conclusion:

In the realm of finance, the phrase “Ponzi scam” serves as a cautionary tale against the allure of quick and unrealistically high returns. Recognizing the key characteristics and understanding how these schemes unravel is crucial for investors to safeguard their hard-earned money. As the financial landscape continues to evolve, staying informed and skeptical is the best defense against falling victim to such fraudulent schemes.