Credit One Bank Scam: Is Accept Credit One Bank A Scam?

In the ever-evolving landscape of online banking and financial transactions, consumers must remain vigilant to protect themselves from potential scams. Unfortunately, one such scheme that has gained notoriety is the Credit One Bank scam. In this blog post, we aim to shed light on the tactics employed by scammers and provide you with essential information to safeguard your hard-earned money.

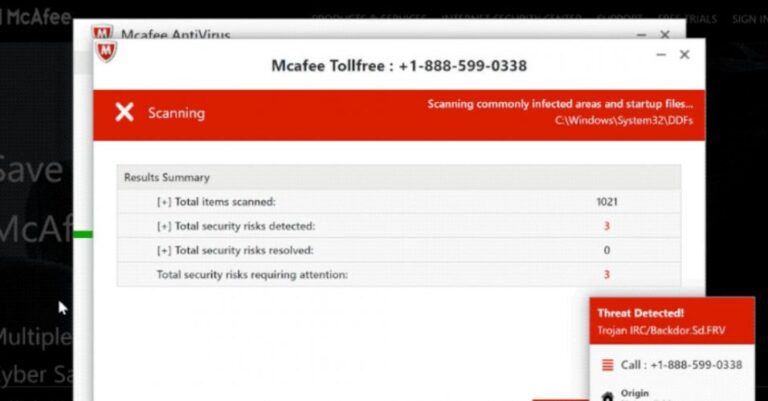

Understanding the Credit One Bank Scam: The Credit One Bank scam operates as a deceptive scheme where fraudsters impersonate the legitimate bank to trick individuals into disclosing sensitive financial information. These scams often involve phishing emails, fraudulent phone calls, or fake websites that mimic the official Credit One Bank platform.

Recognizing Phishing Emails: Phishing emails are a common tool used by scammers to target unsuspecting individuals. In the case of the Credit One Bank scam, these emails often contain alarming subject lines or urgent messages, creating a sense of urgency for the recipient to act quickly. Be wary of unsolicited emails requesting personal information, such as account credentials, credit card numbers, or Social Security numbers.

Bogus Phone Calls: Another method employed by fraudsters is phone calls, where they pose as Credit One Bank representatives. These calls may appear legitimate, with the scammer using convincing scripts and official-sounding language to deceive victims. Remember, legitimate banks will never ask for sensitive information over the phone. If you receive such a call, hang up and contact the bank directly using the official contact information available on their official website.

Fake Websites: Scammers often create counterfeit websites that closely resemble the official Credit One Bank site. These sites may trick users into entering their login credentials or other personal information. Always verify the website’s authenticity by checking for secure connections (https://) and ensuring that the URL matches the official domain of Credit One Bank.

Protecting Yourself from the Credit One Bank Scam:

- Vigilance: Stay vigilant and skeptical of unsolicited communications, whether through emails, phone calls, or messages.

- Verification: Always verify the legitimacy of any communication claiming to be from Credit One Bank. Contact the bank directly using official contact information if you have any doubts.

- Secure Websites: Ensure that any website you access for banking purposes is secure and has the correct URL.

- Education: Educate yourself and your family members about common scams and the tactics used by fraudsters to stay one step ahead.

Conclusion: The Credit One Bank scam serves as a stark reminder of the importance of staying informed and vigilant in today’s digital age. By understanding the tactics employed by scammers and taking proactive measures to protect your personal information, you can fortify yourself against potential threats. Remember, a well-informed consumer is the first line of defense against financial scams. Stay safe, stay informed, and safeguard your finances from the Credit One Bank scam.