Venmo Scams: Protecting Your Digital Wallet from Deceptive Schemes

Venmo, the popular peer-to-peer payment app, has revolutionized the way we exchange money with friends and family. However, its convenience and widespread use have also made it an attractive target for scammers looking to exploit unsuspecting users. In this blog post, we will delve into the world of Venmo scams: what they involve, how they work, and, most importantly, how to recognize and protect yourself from these deceptive schemes.

Understanding Venmo Scams

Venmo scams encompass a range of fraudulent activities that target Venmo users. Scammers often exploit the app’s social and transactional features to trick individuals into sending money or revealing personal information.

The Anatomy of Venmo Scams

Venmo scams typically follow a common pattern, often unfolding as follows:

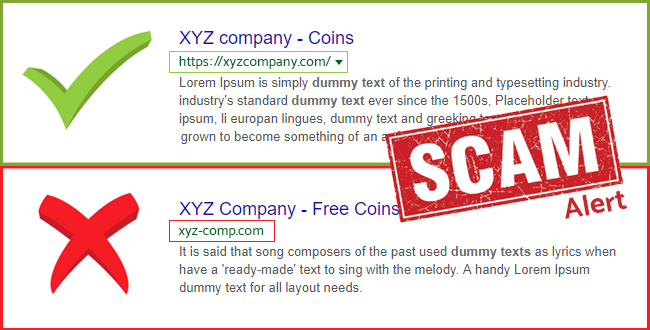

- Impersonation: Scammers may impersonate someone you know or trust, such as a friend or family member, or create fake profiles that resemble legitimate users.

- Fake Transactions: Scammers send fraudulent payment requests, claiming they need money for various reasons, such as an emergency or a shared expense.

- Overpayment Scams: In this scenario, scammers pay you more than the agreed-upon amount for a product or service and then ask you to refund the excess, only for their original payment to bounce or be fraudulent.

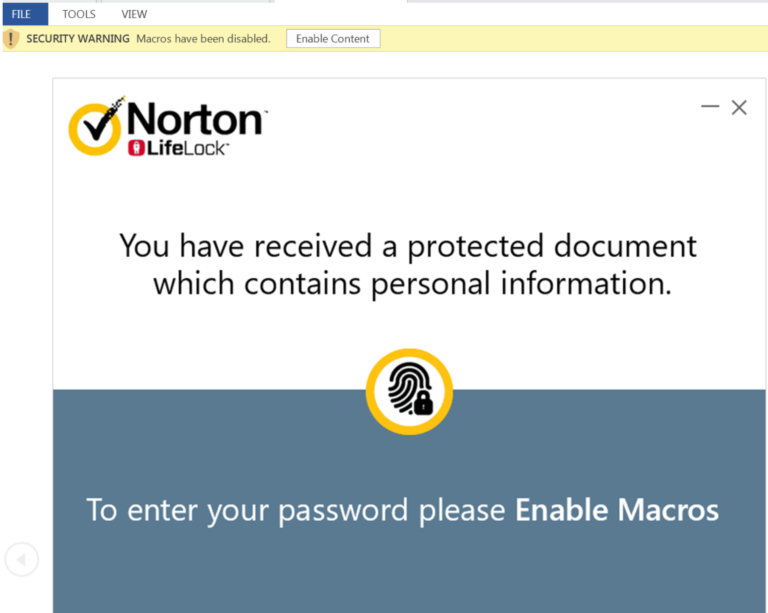

- Phishing Links: Some scams involve sending links that lead to phishing websites designed to steal your Venmo login credentials or personal information.

- Social Engineering: Scammers may manipulate you emotionally, pretending to be in distress or claiming a dire situation to convince you to send money.

- Infiltration of Public Transactions: Scammers exploit the public nature of Venmo transactions to send fake, attention-grabbing messages, hoping you’ll send money out of curiosity.

Recognizing the Red Flags

Spotting the warning signs of Venmo scams is essential for protecting your finances and personal information. Here are common indicators to be aware of:

- Unexpected Requests: Be cautious of unsolicited payment requests, especially from unfamiliar or unverified contacts.

- Overpayment: Avoid refunding money to someone who claims to have overpaid you until you confirm their initial payment is legitimate.

- Phishing Links: Do not click on links in messages from unknown or suspicious sources, as they may lead to phishing websites.

- Urgency: Scammers often create a sense of urgency or desperation to pressure you into sending money quickly. Take your time to assess the situation.

- Check Contact Information: Double-check the contact information of the person or entity requesting money to ensure it’s legitimate.

Protecting Yourself From Venmo Scams

Defending against Venmo scams requires vigilance and informed decision-making:

- Verify Transactions: If you receive a payment request or are asked to send money, independently verify the request by contacting the person through a trusted communication channel (e.g., a phone call or text message).

- Review Transaction Details: Carefully review transaction details, including the recipient’s username and payment description, to ensure they match your expectations.

- Use Privacy Settings: Adjust your Venmo privacy settings to limit who can see your transactions and make them visible only to trusted friends.

- Enable Two-Factor Authentication (2FA): Enhance the security of your Venmo account by enabling 2FA.

- Educate Yourself and Others: Stay informed about common scams and red flags to protect yourself and those around you.

- Report Suspected Scams: If you encounter a Venmo scam or suspect fraudulent activity, report it to Venmo and your local law enforcement.

Conclusion

Venmo scams are crafty and opportunistic, preying on the trust and convenience the app provides. By staying informed, practicing caution, and recognizing the red flags associated with these scams, you can protect your financial assets and personal data from falling into the hands of deceptive fraudsters. Remember that genuine requests for money typically come from people you know and trust, and it’s always wise to verify any unexpected payment requests.